Boat Case Fares Well

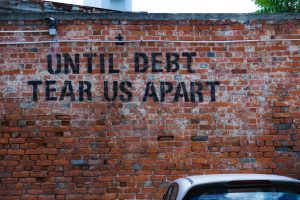

In the few short months following the guilty verdict of accused murderer, Alex Murdaugh, various financial and legal details have continued to resurface, leaving onlookers to question or assess the arguably ugly past of the prominent South Carolina family. Serving two consecutive life sentences, Murdaugh was entrapped in various legal woes that contributed to his debt and the subsequent alleged motivation behind his accused lethal actions in 2021, which left both his wife and son slain. One of the stronger theories of Murdaugh’s intent to kill focuses on his inability to pay his various financial misdeeds, including damages in a wrongful death lawsuit.